(Bloomberg) — Brazil’s state-controlled oil company saw its earnings surge in the second quarter, triggering upgrades and a rally in premarket trading.

Petrobras slashed its debt load and announced early distribution of dividends thanks to the robust results. Credit Suisse Group AG and Scotiabank both upgraded shares to outperform. Its American depositary receipts were up 10% in premarket trading after rising as much as 16% after the results.

A rally in crude prices and a hydropower crunch in Brazil that boosted electricity demand drove the solid results that beat estimates. This year’s oil-price rebound has delivered robust earnings to energy giants, many of which are printing as much profit as before the pandemic. As a result, many of Petrobras’s U.S. and European peers have been using the cash to boost dividends and slash debt. It’s a stunning turnaround for an industry that was on the ropes a year ago amid a pandemic-induced price crash.

Since late last year, Petrobras has sold more fuel oil domestically and increased output at its own thermal power plants, part of a wider policy in Brazil to conserve water levels at hydroelectric dams and avert power outages. Though the power division at Petroleo Brasileiro SA, as the company is formally known, represents a fraction of overall revenue, it was a standout. Electricity generation more than tripled in the second quarter from a year ago.

Petrobras reported 42.86 billion reais ($8.3 billion) of net income, up from 1.17 billion in the first quarter and compared with a loss of 2.7 billion reais in the second quarter of last year, at the height of the Covid crisis.

The strong results will allow the company to bring forward shareholder payouts of 31.6 billion reais for this year, about three times the average that was distributed in the past three years.

“Considering our prospects for earnings and for cash flow generation in 2021, we approved the anticipated distribution of dividends,” Chief Financial Officer Rodrigo Araujo said in a recorded video for investors.

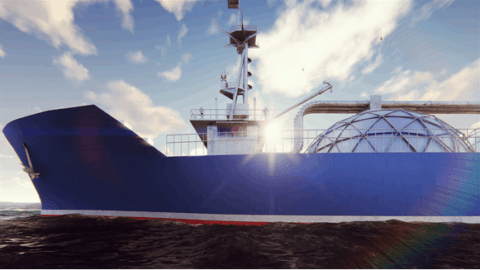

Output from the so-called pre-salt region that holds Petrobras’s largest and most profitable discoveries continues to expand. A 180,000-barrel-a-day production vessel is expected to start this month and gradually ramp up at the Sepia field. This and other new units allow Petrobras to continue boosting output at ultra-deep fields, and compensate for production it has lost due to asset sales and natural declines at legacy fields.

Petrobras continued to slash what was once the biggest debt load of any publicly traded oil company, which stood at $63.7 billion at the end of the second quarter. The company has vowed to increase dividend payments when it brings total debt below $60 billion, a target it is on pace to reach before the end of this year, Araujo said. The ongoing divestment program has helped Petrobras trim debt. It has raised $2.8 billion from selling assets for the year through Aug. 3.

It was the first quarter under the management of Chief Executive Officer Joaquim Silva e Luna, a former general who took over in April following a row between President Jair Bolsonaro and the previous CEO about rising diesel prices. Luna has pledged to avoid fuel subsidies and continue with Petrobras’s current business plan, which calls for divesting assets including refineries to focus on its most profitable projects in the pre-salt.

“We continue to work hard, supported by decisions that are absolutely technical, and evolving and becoming stronger,” Luna said in the earnings report.

Investors are waiting to see how strongly Luna will defend Petrobras from political intervention. The company recently denied a claim from Bolsonaro that it had earmarked 3 billion reais to subsidize cooking gas for families in need.

–With assistance from Vinícius Andrade.

© 2021 Bloomberg L.P.

#Petrobras #Earnings #Jump #Triggers #Upgrades

Tags: Coastal Flow Coastal Flow Measurements Coastalflow Earnings Jump oil and gas petroleum news events stories articles analysis commentary headlines stocks finance commodities maps pictures Petrobras Triggers Upgrades